Tags

Anti-trust law, Barnwell, Barnwell radioactive waste site, Burial of Radioactive Waste, campaign donations, campaign fundraiser, cancer, clean water, Clive, Clive dump, corruption, cost-cutting, cutting corners, dangers of nuclear, Doug Kimmelman, Energy Capital Partners, Energy Solutions, EnergySolutions, environment, for-profit nuclear waste, Goldman Sachs, High Level Nuclear Waste, Investment Bankers, NRC, nuclear, nuclear accident, nuclear disaster, nuclear energy, nuclear power station dismantlement, nuclear reactors, nuclear waste, President Trump, private interim storage, private ISF, Private nuclear waste facility, privatization, radioactive rubble, radioactive waste, radioactive waste burial, risk management, Russia, South Carolina, Spent Nuclear Fuel, Texas, Trump, Uranium mine cleanup, US DOE, US DOJ, US NRC, Utah, water, WCS, Zion Solutions

Private Nuclear Waste “Interim” Storage Facility Comment by Friday, 27 Jan. 2017, 11.59 PM Eastern Time(NY-Boston-DC-Atlanta, Miami, etc.) This is one minute till midnight; one minute till Saturday. Comment here: https://www.regulations.gov/document?D=DOE_FRDOC_0001-3256 ID: DOE_FRDOC_0001-3256. It is easy and can still be anonymous. It is important for the public record. It says that there have been no comments but there have actually been two: https://www.energy.gov/ne/downloads/private-isf

As one feisty and intelligent response points out:

“Then, there is the interesting aspect of private enterprise being used to “safely store” the waste. Gee, do we have any examples of for-profit companies cutting corners? Do they ever go bankrupt and cease operations? Do they ever leave the general public holding the bag for poisoned, played-out mines? Do they ever fail in due diligence on safety matters? Bhopal, for instance, comes to mind. For how long could we trust a private company to care more about the public health and our common future, than for private profit? The idea is insane.” (Christopher Logan Oregon December 21, 2016).

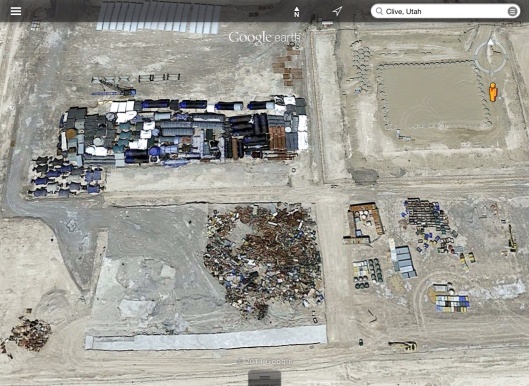

Energy Solutions Clive Nuclear Waste Burial Ground

Spent nuclear fuel parking lot conceptual drawing for WCS as presented to the US NRC

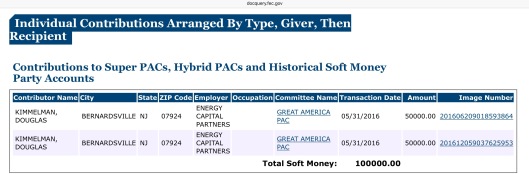

The Private Nuclear Waste “Interim” Storage Facility, i.e. Parking lot for high level nuclear waste, comment deadline is even more important since Doug Kimmelman, an owner of private nuclear waste company EnergySolutions, was a Trump fundraiser and a large Trump donor ($285,000 to $335,000). EnergySolutions is trying to take-over its main competitor WCS, in clear violation of US Anti-Trust law and is being sued by the US government. WCS has applied to be a Private Interim Spent Nuclear Fuel Storage Facility. The donation is on the cheap compared to the benefits which Kimmelman will get if the Anti-Trust lawsuit against his company is dropped by the US government. It is also on the cheap compared to the Las Vegas Sands’ Sheldon and Miriam Adelson’s $20 million plus and the Mercers’ $2 million plus donations, which went into the anti-Hillary campaign after Trump became nominee. However, Kimmelman’s donations were pro-Trump. The combination of Adelson support and Trump’s own Las Vegas hotel appear to ensure that the hard-rock facility at Yucca Mountain will never open. Instead, the waste will be parked and buried near poor people in west Texas and New Mexico, or left parked in poor and rural communities around the country. Even Bernie Sanders has supported the burial of Vermont Nuclear waste at WCS in west Texas, instead of proposing a well-built granite underground, monitored, facility in Vermont or nearby states.

The comment deadline is about Private, so-called Interim, Storage of High Level Nuclear Waste (spent nuclear fuel), which is literally a parking lot without even a cover, in stark contrast to other countries, which keep the waste in buildings. The US Antitrust lawsuit against EnergySolutions, which is trying to buy competitor WCS, to get the virtual monopoly on so-called low level nuclear waste (not truly low level) shows just how dangerous and nasty the private nuclear waste business is. WCS’ application to be a Private Interim Storage Facility for the Spent Nuclear Fuel raised the stakes even higher. The parking lot is sometimes called a “pad” in nuclear waste jargon.

“Low-Level” Radioactive Waste does not mean “low risk.” “Low-level” waste includes the same atoms as high level waste– plutonium, cesium, strontium, and iodine– but in lower concentrations. “https://www.nirs.org/wp-content/uploads/radwaste/llw/senatepresentation032011.pdf

As the lawsuit inadvertently reveals, competition between the parties (EnergySolutions and WCS) for the radioactive waste made the quality-safety decline, along with sometimes a slight lowering of the outrageously prices of these poorly constructed dumps. However, with monopoly, the qualify-safety will almost certainly decline along with prices going up. There is apparently no concern for public safety expressed, only for cost to the nuclear utilities and profits for the corporations.

Nuclear power stations produce radioactive waste continuously. And, once nuclear power stations are shut-down the often radioactive rubble must go somewhere. EnergySolutions’ owns ZionSolutions: “ZionSolutions is using a rip and ship process that will reduce the labor intensive separation of contaminated materials and transport the facility in bulk to the EnergySolutions disposal site in Utah and to WCS in Texas“ https://www.nrc.gov/info-finder/decommissioning/power-reactor/zion-nuclear-power-station-units-1-2.html

If one looks at examples given in the lawsuit (see further below), in conjunction with US proposals to dilute (downblend) uranium and plutonium waste (both US and foreign) for burial, then it’s not too far-fetched to imagine that they will simply eventually tip over spent fuel casks and bury them at the so-called “interim” facility. Here the DOE Draft EA makes clear that WCS of Texas and the EnergySolutions Clive dump in Utah are likely targets of German high level nuclear waste:

https://miningawareness.wordpress.com/2016/03/10/proposed-dumping-of-200-tonnes-of-german-nuclear-waste-on-america-did-the-us-mislead-people-on-the-amount-hidden-in-plain-sight-jein-as-germans-say-oppose-dumping-of-200-tonnes-german-nuc. https://miningawareness.wordpress.com/2016/03/31/treasonous-nuclear-security-hoax-us-to-bury-foreign-plutonium-at-wipp-site-in-new-mexico-formally-approved-import-of-more-foreign-waste-may-be-negotiated-today-tomorrow-under-pretense-of-nuclear/

From the US DOJ Antitrust lawsuit Case 1:99-mc-09999 Document 685 Filed 11/16/16 one learns:

“… WCS obtained a license from the TCEQ to dispose of Lower Activity LLRW in its Resource Conservation and Recovery Act (“RCRA”) landfill, also known as its “Exempt Cell,” adjacent to its Andrews facility… ES [Energy Solutions] immediately viewed WCS’s Exempt Cell as the most significant threat to its dominance to emerge in years. An ES internal report in March 2014 observed that the “[f]riendly regulatory environment in Texas has allowed WCS to dispose of much higher levels of radioactive wastes as exempt in their RCRA site.” The report warned that the new WCS Exempt Cell “[c]an affect ~90% by volume of Clive bulk waste disposal up to $50M/yr…

In response to competition from WCS’s Exempt Cell, ES agreed in the first quarter of 2015 to discount a utility’s LOP contract prices by 9% over the next 5 years, for an annual savings of approximately $1 million per year. ES’s senior executives supported the price reduction because “the alternative is WCS.” …

To provide generators in the Relevant States an option for managing Higher Activity LLRW after Barnwell’s closure, ES in 2011 entered into a joint venture called SempraSafe with the firm Studsvik. ES and its joint venture partner refined the downblending process by which Higher Activity LLRW (typically resins) are mixed with Lower Activity LLRW until the resulting mixture qualifies for disposal as Lower Activity LLRW at ES’s Clive facility. The residual portion of the waste that could not be downblended was sent to WCS – initially for storage, and later for disposal – after Andrews became operational in 2012.

In early 2014, ES acquired Studsvik and renamed the SempraSafe operation Erwin ResinSolutions (“Erwin”). Over time, ES has become more effective at downblending materials with higher levels of radioactivity.

After WCS began operations, commercial LLRW generators in the Relevant States had two options for the dispositioning of certain Higher Activity LLRW: (i) processing by ES at Erwin plus disposal at ES’s Clive facility or (ii) direct disposal at WCS’s Andrews facility.

The introduction of competition had a significant impact on prices for the dispositioning of Higher Activity LLRW. As one of ES’s senior executives wrote in a December 2014 email, “[w]e saw resins prices drop by what 50%?” …” Case 1:99-mc-09999 Document 685 Filed 11/16/16 https://www.justice.gov/opa/press-release/file/910956/download

Waste Control Specialists (WCS) near Andrews Texas:

Energy Solutions Barnwell Burial Ground

Large Nuclear Components at Energy Solutions Clive Facility

The Antitrust lawsuit points out that “… the proposed transaction would create a near-monopoly for the disposal of commercially generated LLRW in the Relevant States at a time when utilities are preparing to bid out nuclear reactor decommissioning projects worth billions of dollars…. For a number of years, ES was the only LLRW disposal facility available to commercial LLRW generators in the Relevant States. Then, in 2012, after investing several hundred million dollars and 19 years to build and obtain the necessary licenses for a state-of-the-art LLRW disposal facility, WCS began to compete with ES to dispose of LLRW generated by nuclear power plants, hospitals, and research facilities in the Relevant States.

5. ES has repeatedly tried to neutralize the most significant source of competition it has ever faced. For example, in February 2014, ES executives considered whether to “[k]eep margins as high as possible competing with WCS (winning some losing some)” or “just go to war” with WCS by undercutting it on price and taking market share for the disposal of certain types of LLRW. ES hoped that “~12 months of take the gloves off war” would force WCS “to sit down and listen, or weaken them to the point we can acquire them.”

6. In the face of aggressive competition from WCS, ES decided to eliminate the threat by seeking to acquire it. During March 2014 acquisition discussions, one of ES’s investors urged ES to make WCS an all-cash offer, writing: “These guys are scary – just give them the $275 [million].”

7. After WCS rebuffed ES’s overtures in January 2015, ES tried a different approach. In a February 10, 2015 letter, ES threatened to sue WCS for alleged antitrust violations, asserting that WCS was violating the antitrust laws by trying to eliminate ES as a competitor for the disposal of certain LLRW. This threat led to litigation between the two companies (the “Prior Litigation”).

8. Like ES, WCS recognized that the two rivals were at “war.” According to a WCS internal report in March 2015: “ES is attacking on every front, Texas legislation, Commission, South Carolina, and market place… It is believed that ES is rolling the prices back to 2008 levels.”

9. As 2015 progressed, competitive pressure from WCS increased. In May 2015, ES reduced its prices for the dispositioning of certain LLRW “to combat the recent road tour by WCS a few weeks ago when they lowered the price.” An ES internal report warned that “WCS continues to devalue the market.” In a June 2015 document, an ES executive fretted that “[w]e needed to change pricing approach in order to compete with WCS continued price spiral downward.” An ES senior executive aptly captured this pricing war when he testified: “WCS gave the customer the lowest possible price and we followed suit and gave the customers the lowest possible price.”

10. Unable to shake off its competitor, and following the unsuccessful August 2015

mediation of the Prior Litigation, ES again sought to acquire its rival by approaching WCS’s parent company about a possible merger. Those negotiations ultimately led to the announcement of this transaction in November, 2015. This transaction would, as the parties’ internal documents acknowledge, allow ES to acquire its primary competitor…” Case 1:99-mc-09999 Document 685 Filed 11/16/16. https://www.justice.gov/opa/press-release/file/910956/download

About the absurdity of pretending that dilution is a solution: “Logic would suggest that if you keep adding more of something to a heap, the total amount would become greater. According to TDEC, this logic does not apply to radioactive waste. No matter how much is added, it all amounts to 1 millirem of exposure per year, forever and ever.” “Nuclear Waste in Tennessee“: https://www.nirs.org/radwaste/llw/senatepresentation032011.pdf This was written about the Tennessee Dept. of Environment, but appears to be the same illogic used by all, or almost all, nuclear-radiation policy makers.

About the dilute and deceive (downblending) scams, etc.:

Burying Dangerous Radioactive Waste in Texas- LLW Another Dilute & Deceive Scam

How Lucrative is Burying Radioactive Rubble? Valhi-WCS in West Texas USA

The Dangerous US NRC Typo Making “Low Level” Radioactive Waste More Radioactive than Allowed at WIPP

“ECP II is owned and managed by the ECP II Managing Members, who are five individual U.S. citizens: Douglas W. Kimmelman (individually and through his estate planning vehicle); Thomas K. Lane (individually and through his estate planning vehicle); Andrew D. Singer; Tyler Reeder; and Peter Labbat. / Less than 40% of the equity in all of the ECP II Partnerships and the Controlling Partner is held by various Passive Investors that are foreign domiciled entities, and no foreign domiciled entity or group of foreign domiciled entities under common control holds more than 12% of these equity interests.The Passive Investors will have no ability to exercise control or domination over the operations of Rockwell, ES, or any of the ES subsidiaries, including ZS. / Rockwell Holdco, Inc. (“Rockwell”), a Delaware corporation that was formed for the purpose of acquiring ES and is held by certain investment fund entities organized by controlled affiliates of Energy Capital Partners II, LLC (“ECP II”), a Delaware limited liability company.“. http://www.nrc.gov/docs/ML1301/ML13014A007.pdf

Great Am PAC

Trump Victory PAC

“Energy Capital Partners Raises $4.335 Billion for Fund II”

Aug 16, 2010, 17:00 ET from Energy Capital Partners

http://www.prnewswire.com/news-releases/energy-capital-partners-raises-4335-billion-for-fund-ii-100795434.html

“… EnergySolutions, Inc. (“ES”), would be acquired by Rockwell Holdco, Inc. (“Rockwell”), a Delaware corporation that was formed for the purpose of acquiring ES and is held by certain investment fund entities organized by controlled affiliates of Energy Capital Partners II, LLC (“ECP II”), a Delaware limited liability company. ECP II has over $4 billion of capital commitments under its management and is focused on investing in the power generation, electric transmission, midstream gas, renewable energy, oil field services and environmental services sectors of North America’s energy infrastructure. Partners GP II, LP (“the Controlling Partner”), a Delaware limited partnership. These investment funds are wholly owned either indirectly or directly by the Controlling Partner and various passive limited partner investors. The Controlling Partner itself is owned by ECP II and various passive limited partner investors, and controlled by ECP II. ECP II is owned by five U.S. citizens (the “ECP II Managing Members”) and their estate planning vehicles, and is controlled by the ECP II Managing Members….” https://www.nrc.gov/docs/ML1302/ML13022A410.pdf

https://www.sec.gov/Archives/edgar/data/1393744/000110465913027341/a13-9601_18k.htm

https://www.sec.gov/Archives/edgar/data/1393744/000110465913030306/a13-1707_48k.htm

https://adviserinfo.sec.gov/IAPD/Content/Common/crd_iapd_Brochure.aspx?BRCHR_VRSN_ID=378910

https://www.opensecrets.org/orgs/summary.php?id=D000033447&cycle=A

WCS “Public” Version: https://www.nrc.gov/docs/ML1613/ML16133A137.pdf So there is a private version?

NAC: http://www.nrc.gov/docs/ML1410/ML14105A019.pdf

https://www.sec.gov/Archives/edgar/containers/fix290/1393744/000119312507239269/filename1.htm

https://www.sec.gov/Archives/edgar/data/59255/000119312512101411/d278237dex211.htm

https://www.nrc.gov/info-finder/decommissioning/power-reactor/zion-nuclear-power-station-units-1-2.html

https://www.sec.gov/Archives/edgar/data/59255/0001338019-05-000002.txt

According to Hoovers: “Contran is a holding company that owns stakes of varying sizes in subsidiaries, including the largest, Valhi, Inc. (a publicly traded company about 93% controlled by Contran).” Valhi owns WCS (Waste Control Specialists). Contran is controlled by the heirs of Harold Simmons.

See Harold Simmons Estate https://www.sec.gov/Archives/edgar/data/72162/000007216214000003/f3nl140219trust2.htm

You must be logged in to post a comment.