Tags

conflicts of interest, corruption, Doug Kimmelman, Energy Solutions, Overseas assets, President Donald Trump, President Trump, Putin, recusal, Russia, Sheldon Adelson, tax returns, Trump, Trump tax returns, White House petition

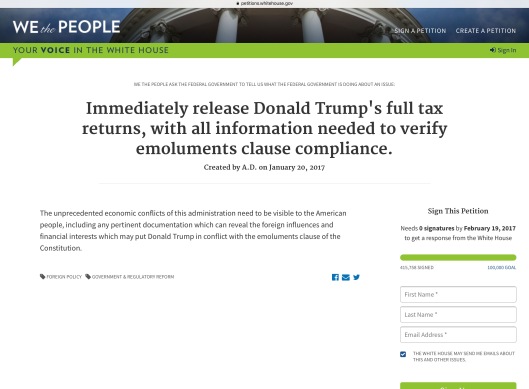

As of almost 9 pm on Sunday night, US Eastern Time, the petition is at 429,493 signatures listed. Sign petition here: https://petitions.whitehouse.gov/petition/immediately-release-donald-trumps-full-tax-returns-all-information-needed-verify-emoluments-clause-compliance. [Note that people are signing on faster than we can keep up. Thus, the text below reflects the status at 7.49pm ET. 1270 more people signed on in a little over one hour! See many screenshots at post bottom. After this post went up, 254 signatures were deleted sometime between 8.55 pm and 9.09 pm. See screen shots at very bottom of this post! This is the second deletion of signatures which we have caught since this afternoon. Also there may be additional failures to update-deletions. ]

The Petition was started on January 20th. 428,223 were listed as having signed by ca 7.49 pm US Eastern Time (ET), Sunday, Jan. 29, 2017; 426,908 were listed as having signed by ca 5.23 pm ET; the figure stood at 425,628 ca 4.07 pm ET . 425,007 were listed as having signed by ca 3.21 pm ET. Whereas the numbers jumped from 424,335 to 425,007 within 25 minutes between ca 2.05 pm and 2.30 pm, it was suddenly frozen at 425,007 from 2.30 pm to 3.21 pm. Sometime between 3.21 and 4.07 pm the numbers went up to 425,628.

Whereas 423,696 were listed as signed ca 1.29 pm ET, by ca 1.45 pm Eastern the figure stood at 424,353. However, by 1.53 pm Eastern it had dropped back down to 424,335! Our screenshot with time (below) shows that figure for 2.05 pm.

At circa 11.29 am Eastern, 422,043 were listed as having signed. At ca 2.43 am Eastern Time it was at 415,758.

It has grown rapidly, despite deletions – 12,465 signatures added in around 17 hours. We have no way to know if the deletions were legitimate or not (e.g. double signing).

Everyone please start taking screen shots with time and if possible time and date. It’s clearly risky to leave the petition in the hands of a White House that refuses to release its tax forms anyway.

Now that Trump is president, how will we know if the tax forms were tampered with by the administration? Furthermore, there is reporting of overseas assets (bank accounts over a certain amount, etc.), which may not be taxable and might not appear on the tax form and yet represent a conflict of interest. These should be registered with the US Treasury if they exceed a certain amount. Then there are potential conflicts of interest through his children, children’s spouses and friends, and even possibly his spouse.

There is also the overt problem of over $20 million donated by Las Vegas Sands casino magnate Sheldon Adelson and his wife Miriam to help elect President Trump. Adelson is apparently pro-Israeli settlement, but has some additional interests – some known and some surely unknown. He has reportedly spoken up for more H1B legal economic immigration. H1B migrants easily and quickly become permanent residents. H1B is the real problem rather than refugees! Blockage of Yucca Mountain nuclear waste facility is almost certainly to continue due to both Adelson and Trump properties in Las Vegas. There are also smaller Trump donors with apparent agendas – known and unknown. Recently the US DOJ filed an anti-trust lawsuit attempting to block absorption of nuclear waste company WCS by competitor Energy Solutions. Doug Kimmelman, an owner of Energy Solutions, gave around $300,000 to Trump’s campaign, as well as reportedly holding a fund-raiser.

There need to be more calls for recusal in government. Whereas some conflicts of interest remain unknown for President Trump, campaign donations are largely known for the President and Congress:

“Outside the judicial system, the concept of recusal is also applied in administrative agencies. When a member of a multi-member administrative body is recused, the remaining members typically determine the outcome. When the sole occupant of an official position is recused, the matter may be delegated to the official’s deputy or to a temporarily designated official; for example, when the Solicitor General of the United States is recused from a case, the Deputy Solicitor General will handle the matter in his or her place./. Concepts analogous to recusal also exist in the legislative branch. The rules of the United States Senate and House of Representatives provide that a Member should not vote on a measure as to which he or she has a personal financial interest. In such cases, the Senator or Representative may record a vote of “present” rather than “yea” or “nay“. https://en.wikipedia.org/wiki/Judicial_disqualification

Trump tax petition 01/29/17 ca 1.45 pm ET 424,352 – unfortunately we didn’t have a time on this one so can’t prove that it dropped. (It actually dropped by 1.53 but our screenshot is at 2.05.) We can only warn people to keep a sharp eye out.

Trump tax petition 01/29/17 ca 2.05 pm ET 424,335

Trump tax petition 01/29/17 ca 2.26 pm ET 424,865

Trump tax petition 01/29/17 ca 2.30 pm ET 425,007

Suspiciously frozen. Can nothing have happened on such a busy petition for almost an hour on a Sunday?

Trump tax petition 01/29/17 ca 3.21 pm ET 425,007

Trump tax petition 01/29/17 ca 4.07 pm ET 425,628

Trump tax petition 01/29/17 ca 5.23 pm ET 426,908

Trump tax petition 01/29/17 ca 7.49 pm ET 428,223

Trump tax petition 01/29/17 ca 8.55 pm ET 429,493

Trump tax petition 01/29/17 ca 8.55 pm ET 429,239

Sign here: https://petitions.whitehouse.gov/petition/immediately-release-donald-trumps-full-tax-returns-all-information-needed-verify-emoluments-clause-compliance

You must be logged in to post a comment.