Tags

1929 Stock Market Crash, 2008 Financial Crisis, 2008 Stock Market Crash, banking crisis, Consumer Financial Protection Bureau, Democrats, Dodd-Frank, Elizabeth Warren, financial crisis, Great Recession, House, predatory financial institution, predatory financial practices, Republicans, Stock Market crashes, US Congress, Wall Street Reform and Consumer Protection Act, Wrong Choice Act

“To date, over 130 groups have submitted letters opposing all or part of Chairman Hensarling’s Wrong Choice Act 2.0 ahead of the Committee markup of the bill on Tuesday, May 2, 2017.” (29 April) http://democrats.financialservices.house.gov/news/documentsingle.aspx?DocumentID=400460

“Earlier this week, the [House] Majority [Republicans] held a hearing during which their witnesses shared so many “alternative facts” that I was sure they must be living in an alternative reality.

Today, Democrats [House Minority] are going to set the record straight. We’ve asked for this second hearing to hear from experts and well-informed witnesses who know, understand and appreciate the importance of the Dodd-Frank Wall Street Reform and Consumer Protection Act, and who can point out the dangers of the Wrong Choice Act.

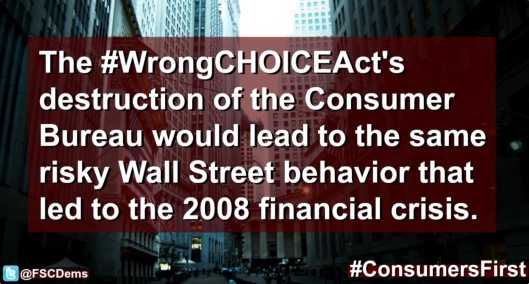

The Chairman’s Wrong Choice Act destroys Wall Street reform, guts the Consumer Financial Protection Bureau, and returns us to the financial system that allowed risky and predatory Wall Street practices and products to crash our economy.” (Waters, 28 April 2017)

Link: http://youtu.be/_1IQMmxpeH8

“Waters Slams the Wrong Choice Act During Historic Minority Day Hearing Washington, DC, April 28, 2017

Today, at the historic Minority Day Hearing of the House Financial Services Committee, Ranking Member Maxine Waters (D-CA) delivered the following statement:

As Prepared for Delivery

Thank you, Mr. Chairman, and thank you to the witnesses for joining us today, especially Senator Elizabeth Warren, who created the idea of the Consumer Financial Protection Bureau, and gave the force behind making it a reality.

Earlier this week, the Majority held a hearing during which their witnesses shared so many “alternative facts” that I was sure they must be living in an alternative reality.

Today, Democrats are going to set the record straight. We’ve asked for this second hearing to hear from experts and well-informed witnesses who know, understand and appreciate the importance of the Dodd-Frank Wall Street Reform and Consumer Protection Act, and who can point out the dangers of the Wrong Choice Act.

The Chairman’s Wrong Choice Act destroys Wall Street reform, guts the Consumer Financial Protection Bureau, and returns us to the financial system that allowed risky and predatory Wall Street practices and products to crash our economy.

We all remember the dark days of the financial crisis and the Great Recession – the 11 million Americans who lost their homes to foreclosure, the 13 trillion dollars in household wealth that went up in thin air, the 10 percent unemployment rate, and the many retirements deferred. This bill would erase all of the progress we’ve made since then, and put us on the road back to economic ruin.

It’s not just a bad bill – it’s an expansively bad bill, with repercussions for our whole country.

Astonishingly, the Chairman had only planned a single hearing on the Wrong Choice Act. Democrats held 41 hearings in this Committee to consider the House version of Dodd-Frank before its passage. It was a transparent, open process that carefully considered a variety of perspectives to ensure a sensible, well-considered set of reforms.

The Republican approach stands in stark contrast. The fact that the Majority planned to hold just one hearing before rushing a nearly 600-page bill to markup sure makes it look like they are trying to hide something. It must be that they realize that the optics of this Wall Street giveaway bill are pretty bad, and hoped the American people were not paying attention.

Democrats are not going to tolerate that – which is why we are here today. Now, even with this additional hearing, we cannot fully cover all of the many ways this bad bill would hurt hardworking Americans. We would need dozens more hearings to do that.

But with this slate of outstanding experts here today, we will have the opportunity to educate the public about some of the harmful repercussions of the Wrong Choice Act.

We will also discuss why Dodd-Frank protections and the Consumer Financial Protection Bureau are so important for American families and for our shared prosperity as a nation.

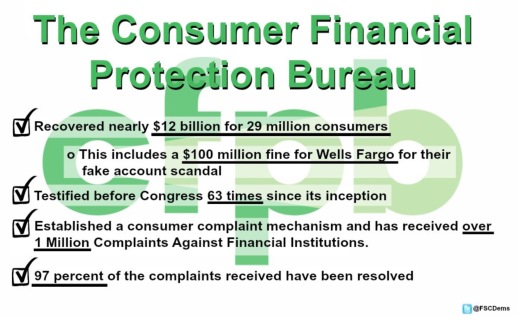

In its work for the American public, the Consumer Bureau has returned nearly 12 billion dollars to more than 29 million consumers who have been victim to predatory financial institutions. And so, I’m looking forward to hearing the testimony of the witnesses here today, and sharing the facts with the American people about this harmful bill. I now yield the remainder of my time to the Vice Ranking Member, Mr. Kildee. http://democrats.financialservices.house.gov/news/documentsingle.aspx?DocumentID=400459

Warren link: http://youtu.be/UlnpcAwGswU

(Earlier) Kildee Link April 5, 2017: http://youtu.be/hkPTpyk6wUw

[Kildee is from “Kil” meaning church or chapel in Irish Gaelic.]

Now we know the real reason why Trump was critizing Elizabeth Warren at the NRA – she is trying to block Trump and his Wall Street friends-appointees from robbing people and collapsing the economy again. If you look at the history of the 20th and 21st century, the times there was a Republican majority in both US Houses of Congress for an extended period, combined with a Republican President, they deregulated Wall Street; Banks, and crashed the stock market, banks, and the economy. https://en.wikipedia.org/wiki/Presidents_of_the_United_States_and_control_of_Congress

https://www.c-span.org/video/?c4667595/president-trump-looks-ahead-2020-election-remarks-nra-meeting

You must be logged in to post a comment.